Tax Structuring Through Investment Vehicles in India

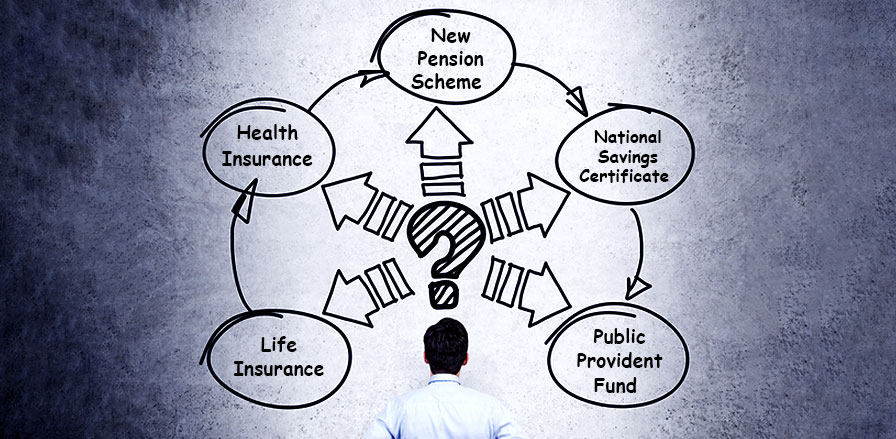

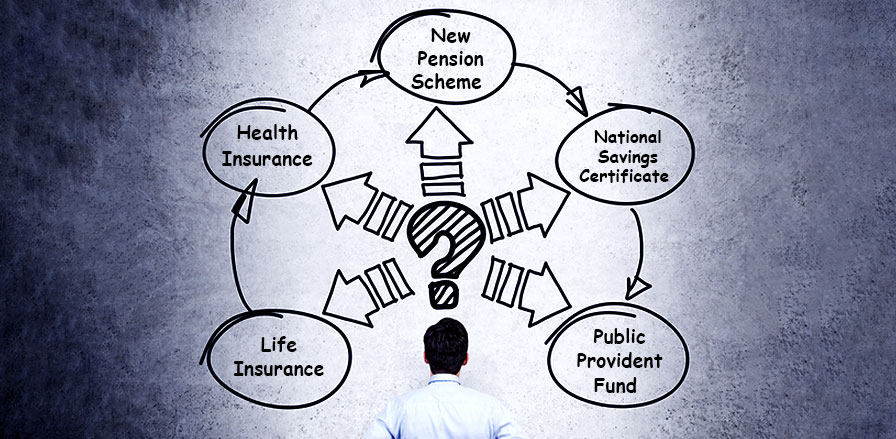

Tax structuring contains the strategies and plans that help reduce tax amounts; a legal way to minimize taxation and keep as much wealth as possible. Investment vehicles are products or modes of investment used for positive gains/returns and are used for reducing tax burdens by exercising exceptions in law. Some tax-efficient investment vehicles include insurance, PPF, NPS, deposits, etc. Exceptions can be sought through the Income Tax Act while using these investment vehicles.

Fri Nov 11 2022 | Govt. Agencies and Taxation | Comments (0)

Like

Like

Tax structuring are the strategies and plans that help reduce tax amounts for self, businesses or estates. It is common practice and an essential aspect of tax planning. Tax structure assessments will assess the opportunities and methods to save on tax, based on personal and business assets and financial well-being.

In simple terms, tax structuring is nothing but a legal way to minimize taxation and keep as much wealth as possible.

What are investment vehicles?

Investment vehicles are products or modes of investment used for positive gains/returns. Such investment can be low or high risk and can be tax-free. It is a method that allows the wealth to grow. Several types of investment vehicles are held in portfolios. This diversifies the portfolio and minimizes risk with different types of assets and tax benefits.

Each investment vehicle has its associated risks and rewards. A decision on what best suits a portfolio depends on risk tolerance, financial stability and investment nuance. While deciding investment vehicles, the following elements must be examined:

- Expected return

- Risk

- Liquidity

- Cost

- Structure

- Pricing

Direct vs. Indirect investment vehicles

| Sl. | Direct | Indirect |

| 1. | Specific assets or securities, e.g.: stocks & bonds | Own direct investments, e.g.: mutual & hedge funds |

| 2. | Lower fees | Higher fees |

| 3. | No portfolio manager | Managed by portfolio manager |

| 4. | Complete control | Lesser control |

| 5. | Public and private | Public and private |

Tax-efficient investing vehicles

Tax-efficient investing is important because a lot of one’s earning goes into paying taxes – when this money could generate some income if smartly invested. Actual earning is always the after-tax returns as that is the actual income. Therefore, to generate tax-free income, the following investment vehicles could be used:

- Life Insurance

All types and forms of life insurance qualify for tax exemptions. These include life insurance, education insurance, house insurance, etc. Exemptions can be sought under Income Tax Section 80C and 10(D). Investments in unit-linked plans (ULIPs) can also help in achieving financial goals tax-free. ULIPs are marked-linked and are suitable for medium to high risk takers.

- Public Provident Fund (PPF)

PPF is a government sponsored savings and retirement plan, leading to tax free investment. It helps those who are without a structured pension plan. Regular interest is earned on PPF in accordance with the debt market. The PPF has a minimum tenure of 15 years. Benefits are again sought under Section 80C and 10(D) of Income Tax Act.

- Senior Citizen Saving Scheme (SCSS)

The Senior Citizen Saving Scheme is a government-sponsored savings scheme for individuals who are more than 60 years old. It offers significant returns and can provide them support in their post-retirement phase. The principal amount, which can max out INR 1.5 lakh, deposited in the SCSS account is eligible for tax deductions under Section 80C of the Income Tax Act, 1961. It must be noted that the interest received is subject to taxation as per the tax slab applicable on the policy holder.

- New Pension Scheme (NPS)

NPS helps individuals save for retirement. All citizens aged between 18-60 years can participate in the NPS scheme. Fund management charges are low and hence it is cost effective. Given the variation, NPS is beneficial for all individuals with varying risk tolerance. The aggregate limit of deduction under all the sub-sections of Section 80C, like 80CCD, 80CCC cannot exceed INR 1.5 lakhs.

- Deposits

5-year bank fixed deposits are also tax-saving deposits offering tax free income and growth in wealth. With minimal risk, it is one of the most preferred modes of investments over the long-term. Benefit can again be sought under Section 80C of Income Tax Act.

- Health Insurance

Also known as Mediclaim, health insurances cover the expenses incurred due to an accident or hospitalization. Depending upon the insurance amount, it covers the pre- and post-hospitalization charges as well. The key benefit of such an investment for a policy holder is that if they pay for different policies, say INR 20,000 for themselves and INR 15,000 for their parents, they can avail tax benefits of 35000. These benefits can be sought under Section 80D.

- National Savings Certificate (NSC)

National Savings Certificate is a savings bond scheme that aims to encourage small to mid-income investors to invest by providing tax benefits under Section 80C. NSCs can be bought by investors, if they have a savings account with a bank or post office, for themselves, on behalf of a minor, or along with another investor as a joint account. If you have access to Internet banking, you can purchase NSCs in e-mode and start availing of the tax benefits without going through any tedious process.

- Pooled investment vehicles

Investors often pool their investments with others in order to get certain advantages that would not be available individually. Such pooled investments can take the form of mutual funds, pension funds, private funds, etc.

In a mutual fund, a professional chooses stocks, bonds and other assets that could best suit the investor and his portfolio. The professional charges a fee for the same. Pensions funds are those established by an employer in which an employee deposits a part of their income. Private funds refer to pooled investments into private equity and hedge funds. |

Public Investment Vehicles vs. Private Investment Vehicles

| Public Investment Vehicles | Private Investment Vehicles |

- Public investment options are generally available to the public for purchase and doesn’t have a certain qualification that makes you eligible.

| - Private investment vehicles are available only for individuals that meet certain requirements like they earn a specific income or have a specific net worth.

|

- Mutual funds, public provident fund and government bonds are a few examples of public investment vehicles in India.

| - Private investment vehicles include hedge funds, venture capital partnerships and private real estate investment trusts.

|

- The majority of public investments are made through a brokerage firm that act as the middlemen that process the trade for the investors.

| - Private investments are majorly made directly by investors themselves or their official representatives to the company that is looking for investments.

|

Types of tax planning in India

Tax planning in India can take various forms. Most common are listed below:

- Purposive Tax Planning:

Usage of tax provisions to avail tax benefits. Maximum benefit can be sought by making the right program for asset replacement, investments, residential status and expansion of business activities. The taxpayer can try to evade Section 60 to 65 of the Income Tax Act and increase savings after all deductions.

- Permissive Tax Planning:

This refers to tax planning according to what is permissible under the Income Tax Act. Certain provisions, such as Section 80C of the Income Tax Act, provide for exemptions, deductions and concessions. This leads to planning your wealth in accordance with such permissible investments that can help reduce the tax burden and maximize profit/useable income.

- Short-range & long-range Tax Planning

Any plan made for a limited or particular objective, with the aim at executing the plan before the closing of the fiscal year to reduce tax burden, is called short-range tax planning. There is no regular investment or commitment for the same. For e.g.: investment in a PPF account for a fixed period.

However, a tax plan made at the start of the fiscal year, followed around the year with an aim to reduce tax burden in the longer run are known as long-range tax planning. For e.g.: seeking a term life insurance.

Conclusion

It always makes sense to diversify your wealth in a way that gives the best tax benefits. Why would one want to pay more tax than is necessary? A well-thought plan can help in expansion of wealth, whilst ensuring that they remain within the boundaries of law. Tax matters often get obscure; hence, one must always err on the side of caution when using investment vehicles to avoid a tax burden.

Copyright 2024 – Helpline Law - HLL001