To simplify the laws, reduce the tax evasion and remove unnecessary obstacles, the Government of India launched the Goods and Service Tax. This article analyses the impact of GST in the real estate sector. The GST regime has simplified tax payment for the nonprofessional, and also reduced the expenses of real estate developers, thereby, largely benefitting all. Read this article to understand the impact of GST on the sector.

Are you planning to buy a property? It is important to have an understanding of the Goods and Service Tax (GST) rates applicable on real estate.

To simplify the laws, reduce the tax evasion and remove unnecessary obstacles, the Government of India launched the Goods and Service Tax. Central taxes such as Central Excise duty, Additional Excise duty, Service tax, Additional Custom duty and Special Additional duty as well as state-level taxes such as VAT or sales tax, Central Sales tax, Entertainment tax, Entry tax, Purchase tax, Luxury tax and Octroi subsume in GST.

Since real sector was also burdened with various indirect taxes such as VAT, Service Tax, Excise, stamp duty and many more, it was brought under the purview of GST. However, after implementation there has been a slight confusion regarding the rates and benefits. This article aims at providing clarity and to simplify the structure so as to make the investment in real estate easier.

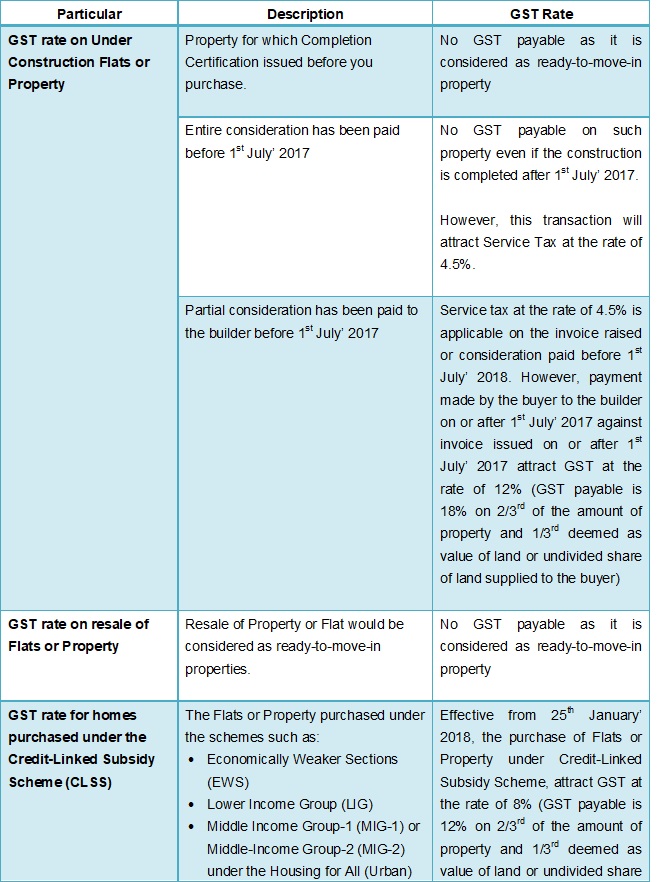

GST @12% with full input credit is applicable on real estate sector. According to the schedule of GST rates for services as approved by the council, real estate sector comprises of a complex, building, civil structure or a part thereof, intended for sale to a buyer, wholly or partly. The value of land is included in the amount charged from the service recipient. This means all under-construction properties will be charged @12% however, no GST would be levied on ready-to-move-in properties. There are various stages of under-construction and GST will be dependent on it.

A Property purchased after the Completion Certificate was issued to the Builder:

Under these circumstances, no GST will be charged as it is considered a ready-to-move-in property and there is no transfer of goods or services.

Payment made to the builder in part or in full before 1st July 2017:

Whether paid in full or half, if the payment is made before 1st July, 2017 (i.e. before GST regime) no GST will be payable on such property. However, service tax @4.5% would be applicable.

GST on under-construction flats, properties or commercial properties:

The actual GST rate applicable is 18% but one-third of this is deemed as the value of land or undivided share of land supplied to the buyer. Therefore, GST rate lowers down to 12% on under-construction flats, properties or commercial properties with full input tax credit.

GST rate on resale of flats or property:

Resale of flat or property would be considered as ready-to-move-in properties and hence, no GST would be payable on the same.

GST rate for homes purchased under the Credit-Linked Subsidy Scheme (CLSS):

If you purchased the property under the schemes like:-

CLSS is meant to provide affordable and cheaper houses for weaker section of the society. These houses will attract GST @8% and not 12% as one-third would be deducted towards the cost of the land.

GST, as expected, turns out to be a sentiment booster for the real estate industry, reviving interest of buyers and investors by bringing more transparency in taxation. According to a report of Edelweiss Securities, with the launch of GST, the prices were expected to drop around one to three percent, if at all.

Prior to GST, taxation was too complicated for buyers. They were liable to pay taxes as per the construction status of the property and the state where it is located. Buyers were supposed to pay VAT, service tax, stamp duty and registration charges for under-construction property or only stamp duty and registration charges for completed property. Furthermore, since these were state levies, each state specified its own rate. So computing taxes were a very difficult process. GST charges all under-construction properties @ 12%, excluding stamp duty and registration charges. No indirect tax is applicable on sale of ready-to-move-in properties, hence the tax will not apply to those. The biggest takeaway is that GST is a simple tax that applies to the overall purchase price.

Benefit to Developers

Earlier developers were charged for Central Excise Duty, VAT and entry taxes collected by the state on construction material costs. Further, he had to pay a tax of 15% on services like labor, architect fees, approval charges, legal charges etc. The tax burden was ultimately transferred to the buyer. However, under the new regime, the changes in construction costs are not grave. Also, reduced cost of logistics will result in reducing expenses as well.

Summary at Glance: