To reduce the burden of compliance of small taxpayers, the Indian Government provides the presumptive taxation scheme, which is easy to comply with. The benefit of this scheme was earlier limited to only specified businesses but now the Government has extended that facility to Professionals also.

A new section has been introduced in the Income Tax Act - Section 44ADA, w.e.f AY 17-18 that aims at simplifying the tax compliance of professionals, particularly small professionals so that it facilitates ease and efficiency in carrying out their professional obligations.

Under this scheme, professionals whose total gross receipts are not more than Rs. 50 Lakhs in a financial year (April to March) can file their return declaring 50% of gross receipt as income and after deductions of section 80, they can pay tax on balance amount.

Who can avail presumptive taxation scheme?

This scheme u/s 44ADA can be availed by freelancers, professionals, and consultants who earn an income by providing their services and expertise. The following are considered professionals who can use this scheme

Further, this scheme is applicable only to resident assessee that includes individual, HUF or partnership but not a limited liability partnership firm.

How will professionals save?

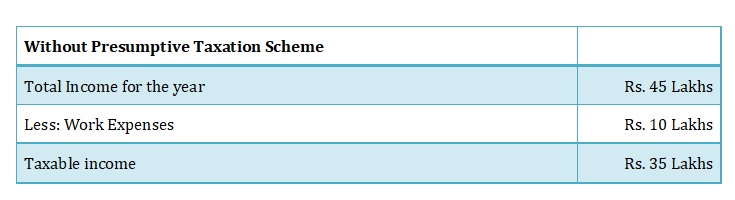

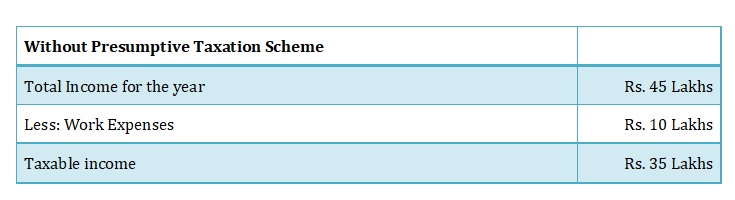

For example, Mr. Jagdish Chand is a successful architect. His total gross income for the FY 2016-17 is Rs. 45 Lakhs. In normal course of things, taxable income will be Rs. 35 Lakhs.

In case of no presumptive taxation scheme, Jagdish will pay tax on Rs. 35 Lakhs that will amount to following:

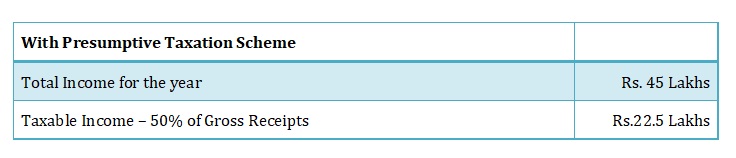

However, if Jagdish opts for presumptive taxation scheme, his taxable income will only be Rs.22.5 Lakhs.

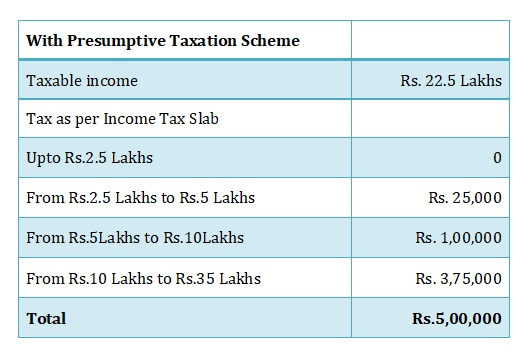

Tax liability under presumptive taxation would be:

Therefore, Mr. Jagdish Chand will save Rs.3,75,000 on income tax under presumptive taxation scheme. Furthermore, he can claim all Section 80 tax-saving deductions and investments over and above the presumptive taxation scheme.

What Deductions are allowed in the Scheme u/s 44ADA?

Following deductions are allowed under the section 44ADA:

a)All deductions from sections 30 to 38 (including depreciation and un-absorbed depreciation / allowances) shall be deemed as allowed and no further deduction is allowed under any of these sections.

b)Written down value (WDV) of depreciable assets shall be recomputed deducting depreciation which is deemed as allowed

Maintaining books of account:

The taxpayer would also NOT require to:-

a)Maintain books of account under sub-section 1 of Section 44AA, or

b)Get the accounts audited under section 44AB

But, if an assessee who claims that his profits and gains from the profession are lower than 50% of gross receipts and his total income exceeds the maximum amount which is not chargeable to income-tax, then, he has to maintain books of account as per section 44AA and get the audited and furnish report u/s 44AB.

Unlike Section 44AD for business, a professional can easily opt in and out of the presumptive taxation scheme without any restriction of the 5 year period. This means a professional can opt this scheme for a year and opt out of it the next year. He/she can further take up the scheme again in the third year.

What if you maintained proper books of accounts and your net taxable income is less than half of your gross total income?

This would mean your work related expenses are higher and your taxable income is less than the total gross receipts. In such a case, you professionals should not avail the presumptive taxation scheme and pay tax on the actual taxable income after getting books audited.

Whether income from foreign clients should also be included?

This is the general confusion with the professionals providing services to foreign clients. The answer is simple - YES. As a resident of India, the income is received in India, hence your global income will be taxed in India. If you are paying taxes on your foreign income in that foreign country, then you can claim tax relief on taxed income (which was taxed twice), while filing return in India.

Benefits of filing return under Presumptive Tax Scheme:

What if you do freelancing work on the side?

These days we often see that salaried employees with a regular day job provide freelance or consulting services in their spare time. In such cases also, you can opt for the benefit of presumptive taxation scheme.

If you have a regular day job and you also do freelancing or consulting, then you have two kinds of income i.e. salary income and non-salary income. Since both are income under the laws, tax would be charged on both. You can simply add your freelancing income to salary income to compute the total taxable income. However, you can use the benefit of presumptive taxation scheme and add only half of your freelance or consulting income to your salary income.

For instance, if your salary income is Rs.22 lakh and your freelance income is Rs 12 lakh, you can use presumptive taxation and add only half of the latter to your total income. This way, your total income for the year will be Rs.28 lakh.

Conclusion:

Main objective behind this Presumptive Taxation Scheme is to minimize the compliance burden on small taxpayers earning through profession and to provide an ease of doing business. This scheme provides a massive relief and encouragement to professionals, freelancers, or consultants. Therefore, next time you pay tax, do not forget to analyze your income u/s 44ADA and avail benefits as such.

Copyright 2024 – Helpline Law - HLL001